.gif)

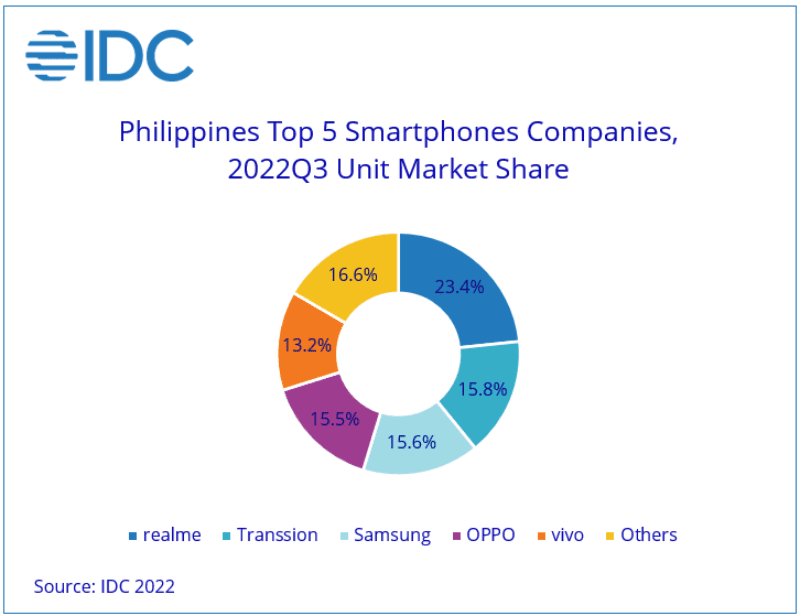

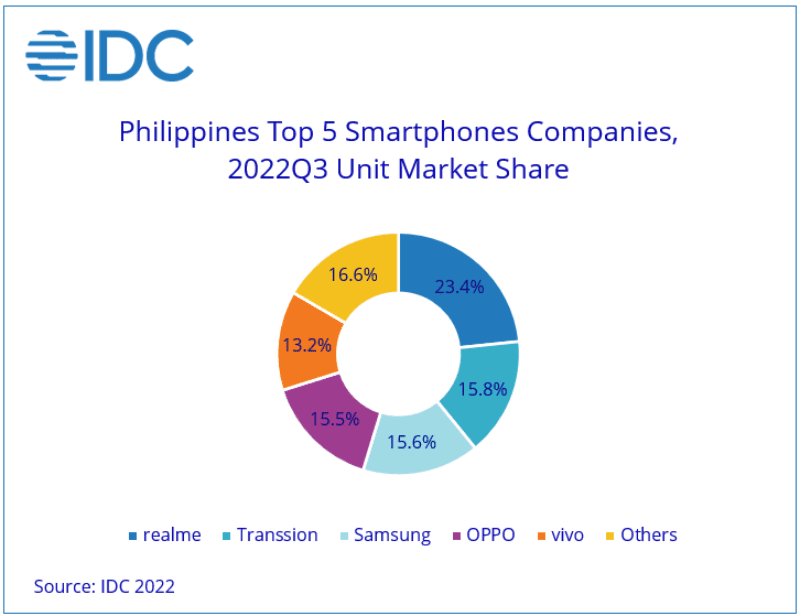

Global market intelligence firm IDC recently shared its 2022Q3 data showing the top 5 smartphone companies in the Philippines.

realme is dominating the PH smartphone scene

According to the report, smartphone shipments in the country declined by 8 percent Quarter-on-Quarter (QoQ) and 6.8 percent annually. The total number of phones shipped in the country last quarter is 3.9 million units. This is the fifth consecutive quarter that the PH smartphone market declined. |

| Top 5 mobile companies in PH |

Despite the decline in total sales, the ultra low-end (<USD 100) price band grew 20.7 percent QoQ and 21.3 percent YoY in 3Q22. IDC noted that consumers sought cheaper options. It's probably one of the reasons why this segment grew.

realme (including narzo) benefitted from this as they stayed on top of the hill by capturing 23.4 percent of the market share. This is a bit higher than its 21.8 percent in Q2. During the quarter, it aggressively pushed narzo, its new "independent" brand.

At number 2 is Transsion, the brand behind Infinix, TECNO, and itel. During the quarter, the group captured 15.8 percent of the pie. The groups notable devices are from Infinix with its budget Smart and HOT Play series.

South Korean tech firm Samsung is at number 3 with 15.6 percent of the pie. OPPO is very close to Samsung with 15.6 percent while its BBK brother vivo captured 13.2 percent.

The rest of the mobile brands in PH combined got 16.6 percent of the market share.

Interestingly, Xiaomi failed to enter the top 5.

Here are the top 5 smartphone vendors in the Philippines (Q3 2022):

1. realme - 23.4 percent

2. Transsion - 15.8 percent

3. Samsung - 15.6 percent

4. OPPO - 15.5 percent

5. vivo - 13.2 percent

6. Others - 16.6 percent

The Philippine smartphone market quickly shrank in the third quarter as inflation accelerated, further aggravated by recent typhoons, hurting both consumers and vendors. Vendors took a more conservative approach by clearing inventories, maintaining prices of existing models, and sustaining momentum by bringing in more affordable smartphones, said Angela Medez, Senior Market Analyst at IDC Philippines.

The last quarter of the year is the peak sales period for smartphones, buoyed by holiday buying. But as inflation is expected to linger and peak towards the end of year, we anticipate an annual shipment decline towards the end of 2022 as vendors will lower targets for the upcoming holiday season by controlling inventories and increasing prices for newer models to counter the depreciating currency, added Medez.

Anyway, the other research firm who released a Q3 2022 report regarding the PH smartphone scene is Canalys. You may check their report here.

What do you guys think?

.gif)

Post a Comment