.gif)

A year after its first approval in the House of Representatives, the proposed bill imposing a 12 percent value-added tax (VAT) on digital transactions is now approved on its third and final reading.  |

| Ready to get the VAT? |

Netflix, Spotify, and Lazada are included on the list

The House Bill (HB) No. 7425, also known as an Act Establishing Digital Taxation in The Philippines, seeks to amend Section 105-A of the National Internal Revenue Code and obligates non-resident digital service providers to collect and remit VAT on transactions passing through their platforms.

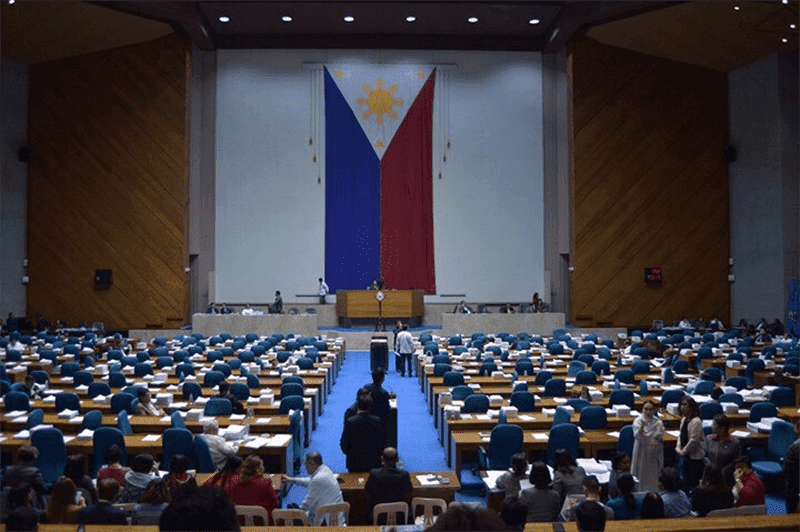

The House of Representatives (HOR) has approved the bill on Tuesday, Sept. 21 with a vote of 167 yes, six no, and one abstain.

HB No. 7425 imposes twelve percent VAT on the sale of the following:

- Goods or properties including those digital or electronic in nature

- Services including those rendered electronically

'Sale or exchange of services' means the performance of all kinds of services in the Philippines, whether rendered electronically or otherwise, including:

- Supply by resident or nonresident of digital services such as online advertisement services

- Supply by resident or nonresident of subscription-based services

- Supply of electronic and online services delivered through IT infrastructure (internet)

According to the bill, the VAT is an indirect tax and the amount of tax may be shifted or passed on to the buyer, transferee, or lessee of the goods, properties, or services.

Digital service provider as described by the House Bill:

- Third-party seller of goods and services who, through information-based technology or the internet, sells multiple products for its own account, or who acts as an intermediary between a supplier and buyer of goods and services collecting or receiving payment from a buyer on behalf of the supplier and receives a commission thereon

- Platform provider for promotion using the internet to deliver marketing messages

- Host of online auctions through the internet

- Supplier of digital services for a regular subscription fee

- Supplier of electronic and online services delivered through an information technology (IT) infrastructure, such as the internet.

It can be recalled that the bill was proposed by House representative Joey Salceda last year.

Iyong malalaking kumpanya katulad ng Netflix, nagbebenta sa Pilipinas kaya dapat magbayad ng VAT. Pero wala nang income tax kasi we did not require them to have a domicile here, he said.

The digital service is defined as "any service delivered or subscribed over the internet or other electronic network and can’t be obtained without the use of IT [information technology]."

Digital services shall include:

- Online licensing of software, updates, and add-ons, website filters, and firewalls

- Mobile applications, video games, and online games

- Webcast and webinars

- Provision of digital content such as music, files, images, text, and information

- Advertisement platform

- Online platforms such as electronic marketplaces or networks for the sale, display, and comparison of prices of trade products/services

- Search engine services

- Social networks

- Database and hosting such as website hosting, online data warehousing, file sharing, and cloud storage services

- Internet-based telecommunication

- Online training such as the provision of distance teaching, e-learning, and online courses and webinars

- Online newspapers and journal subscription

- Payment processing services

You may view the full details of House Bill No. 7425

here.

What do you think guys?

.gif)

Post a Comment