.gif)

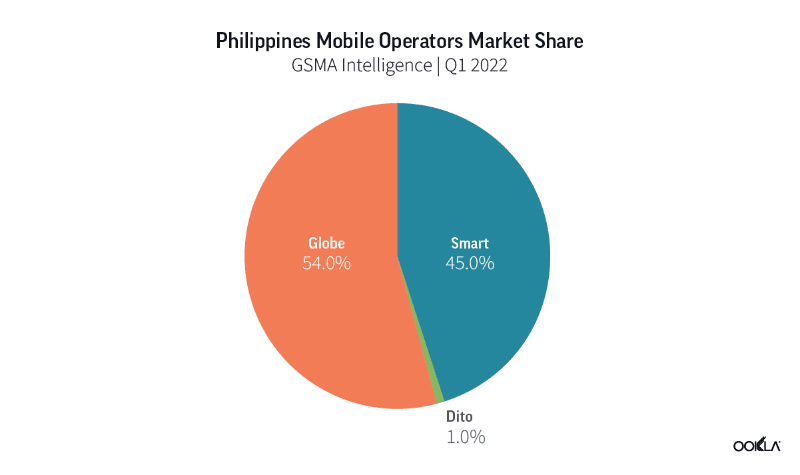

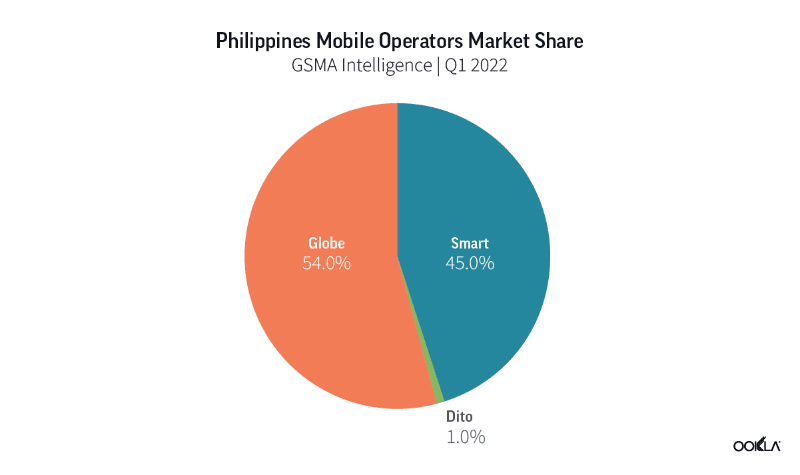

While the Philippine telco market is a "duopoly no more", US internet testing and analysis company Ookla said DITO Telecommunity only managed to secure 1 percent market share in its first year of commercial operations.

|

| PH's major telco players |

DITO impact on 4G and 5G?

Based on its latest report assessing the third telco player's impact on the sector, Ookla said DITO gained 7 million subscribers, which was "lower than we would expect from a new market entrant".

|

| Market share of new player DITO in the Philippines |

However, Globe Telecom and PLDT's Smart Communications still dominated the game with 87.4 million and 70.3 million subscribers, respectively.

DITO previously said it would bank on the implementation of mobile number portability. While its rollout started in September 2021, Ookla said it "hasn’t been as successful as expected" as only 5,000 requests were submitted from September to December 2021.

Despite DITO's slow subscriber growth, its entry into the market contributed to the overall improvement of the Philippines' internet connectivity.

According to Ookla, the country's LTE performance has improved—increasing from 11.15 Mbps in the first quarter of 2021 to 15.53 Mbps in the first three months of 2022.

Our analysis suggests that DITO’s entry combined with regulatory changes, resulted in more network investment and an overall improvement in 4G coverage and performance across all operators, Ookla said.

Citing its Speedest Intelligence data, Caloocan performed best in terms of 4G Availability among the capital's most populous cities.

The country also "fared well" in the 5G race with 163.51 Mbps median download speed in the first quarter.

.gif)

Post a Comment