.gif)

Intel loses worth USD 8 billion (around PHP 435B) in market value a day after they reported disappointing quarterly and full-year 2022 results.

Intel loses USD 8 billion worth of market value!

The tech firm anticipated a Q1 surprise loss and forecasted about USD 3 billion below (around PHP 163B) projections as it also tries to cope with slowing growth in the data center industry.

Intel shares went down by 6.4 percent, while their competitors Advanced Micro Devices (AMD) and NVIDIA garnered 0.3 percent and 2.8 percent, respectively. Meanwhile, KLA corp, Intel's supplier also fell at 6.9 percent after providing bleak projections.

No words can portray or explain the historic collapse of Intel, said Rosenblatt Securities' Hans Mosesmann, who was among the 21 analysts to cut their price targets on the stock.

The dull forecast revealed the difficulties Intel's Chief Executive Pat Gelsinger is dealing with as he attempts to reinstate Intel's dominance in the market by increasing contract manufacturing and establishing new facilities in the US and Europe.

|

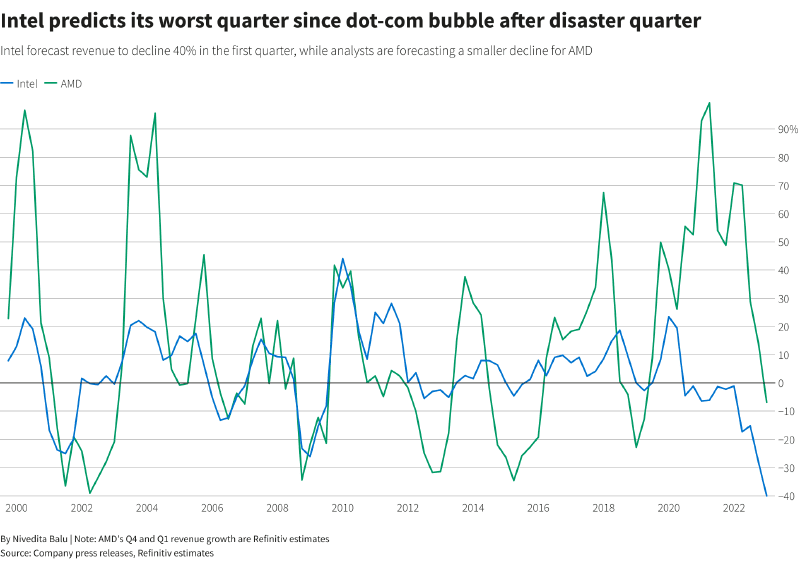

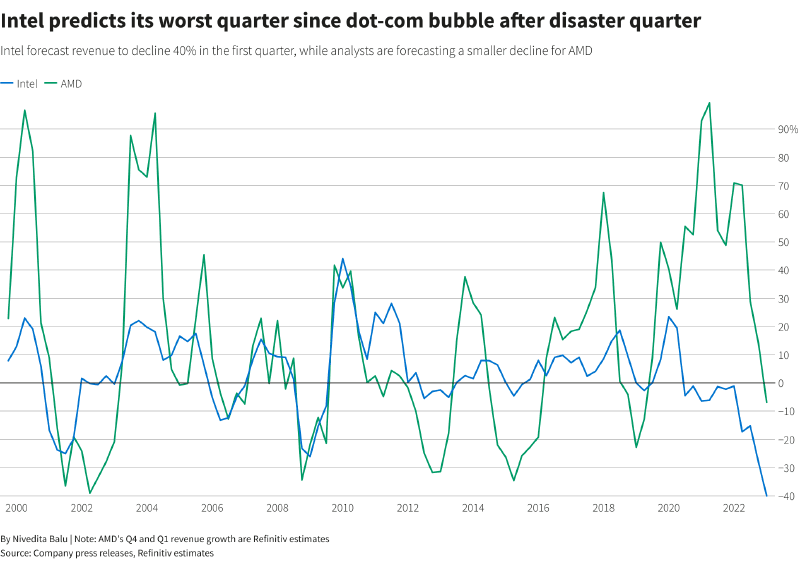

| Photo from Reuters: AMD vs Intel graph 1 |

Moreover, the firm has been gradually losing market share to AMD, who partnered with TSMC to make chips that exceed what Intel can offer.

AMD's Genoa and Bergamo (data center) chips have a strong price-performance advantage compared to Intel's Sapphire Rapids processors, which should drive further AMD share gains," said Matt Wegner, an analyst at YipitData.

|

| Intel vs AMD Graph 2 |

Experts also mentioned that this puts Intel in a bad position even when the data center business bottoms out, which is also expected to happen in the second half of 2022, due to the company will have lost even more shares by that time.

It is now clear why Intel needs to cut so much cost as the company's original plans prove to be fantasy. The magnitude of the deterioration is stunning and brings potential concern to the company's cash position over time, brokerage Bernstein said.

Intel, which intends to bring down costs to USD 3 billion (around PHP 163B) this year, has produced USD 7.7 billion (around PHP 419B) in cash coming from operations and paid USD 1.5 billion (around PHP 81B) in dividends.

Experts also advised that the brand should think about lowering its dividends as capital expenditures are slated to be around USD 20 billion (around PHP 1T) in 2023.

What do you guys think?

.gif)

Post a Comment