.gif)

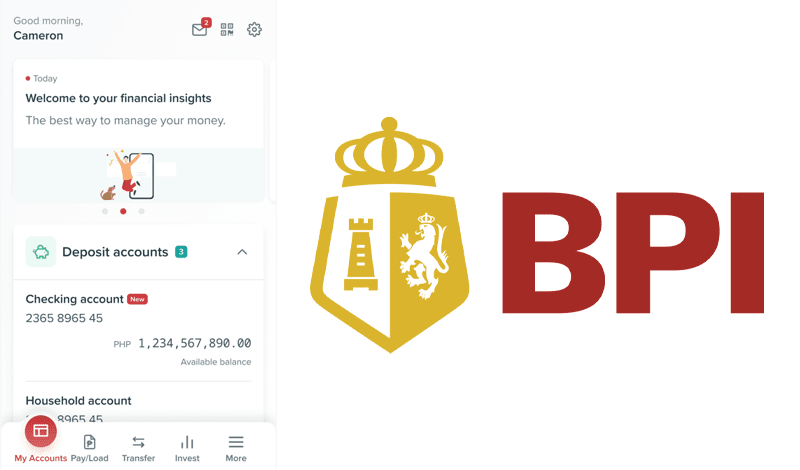

BPI recently launched a new feature on its app that allows its users to track and plan their financial activities.

|

| The Track and Plan tool |

"Track and Plan spending like a boss"

In a statement, BPI said the new feature called “Track and Plan” is a tool that uses AI to track and analyze financial activities on the bank’s app. This also shares insights on spending habits and offers suggestions for financial investments.

We are leveraging technology to simplify money management to empower Filipinos to do more and make their lives better every day. This feature essentially scales BPI’s seasoned and personalized financial advice to millions of Filipinos and is the next step forward in BPI’s evolution. Our customers can look forward to more in-depth insights and actionable advice as we continue to develop this feature, said Mariana Zobel de Ayala, Consumer Marketing and Platforms Head at BPI.

Track and Plan can be seen at the top of the screen when logged in on the BPI app.

This will generate insights based on the user’s cash flow and float up snippets to notify users of their activities.

You can get the full insight with more details when you click on the notification and easily get in touch with BPI if you need to, the company said. Another insight could be about unexpected changes in deposits from a familiar payor made to your account.

This feature can also suggest ways to grow users' extra funds when their balance is consistently high that it sufficiently covers their average monthly expenses.

Track and Plan can also monitor trends in spending and give alerts in case the users' bill is higher than average.

This tool generates unique insights that the user can view. It will continue to give you new insights based on app usage

I have been covering the financial industry for decades and I have never seen a banking app that acts like a financial advisor with powerful access to tools that allow anyone to move from knowledge to action, said veteran journalist and 'Financial Beshie ng Bayan' Salve Duplito. Let's face it, most of us get offended when someone tells us we are spending too much, but with Track and Plan, it's like you telling you! So our emotional human experience gets a big jolt of logic — and that could be transformational in bringing our country's savings rate higher.

BPI said it will continue to expand Track and Plan's capabilities in the coming months so users will eventually have the option to turn on automatic monthly investments, schedule their most frequent transactions, and best of all, stay on top of their spending and earnings with a built-in budget tracker.

What do you think about this?

.gif)

Post a Comment