Transsion continues reign in PH smartphone market in 2023

.gif)

Two studies have shown that Transsion registered the top growth in the PH market last year.

|

| File photo: Infinix ZERO 30 5G, TECNO CAMON |

The PH smartphone market in 2023

|

| Transsion number 1 at Canalys |

According to Canalys' latest report, Transsion led the recovery of the smartphone market as companies focused on increasing their market share "through the introduction of volume drivers" in Q4.

Transsion increased its shipments of its Smart and Spark series and effectively utilized social media platforms to promote its Phantom V Flip model.

The price-sensitive Philippines market experienced the most significant resurgence, achieving a remarkable 32% year-on-year growth, Canalys noted.

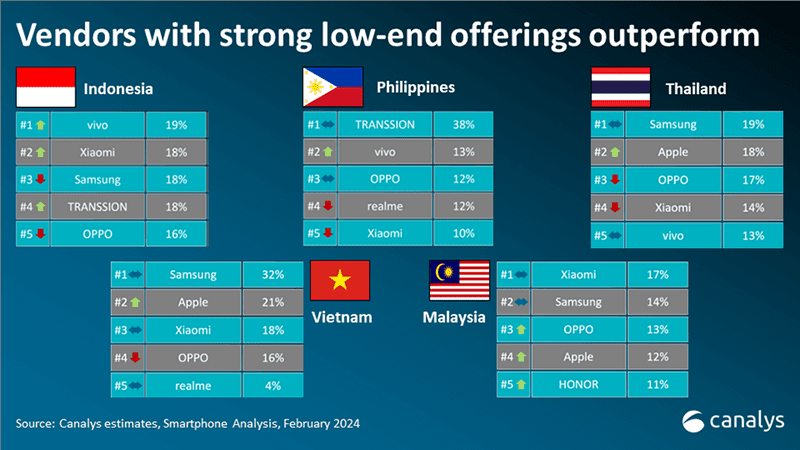

Transsion also ranked first among vendors in the Philippines with strong low-end offerings with 38 percent in 2023.

Devices priced below US$299 continue to drive the majority of sales in Southeast Asia, accounting for a combined 82% of total volume in Q4 2023, stated Le Xuan Chiew, analyst at Canalys.

Leading this charge is TRANSSION which topped smartphone shipments to the region in December for the first time. However, heightened price competition and market saturation pose challenges for vendors when it comes to pricing and positioning products within this segment, the expert noted.

Meanwhile, International Data Corporation (IDC) said in its Quarterly Mobile Phone Tracker that Transsion also took the top spot in market share growth with 98.3 percent annually. This increased from 17.9 percent in 2022 to 34.2 percent in 2023.

|

| Data from IDC |

The brand also accounted for over one-third of total shipments in 2023 as the company reached a new high with all three sub-brands positioned in the ultra-low-end segment (Tecno started to move upwards with the introduction of its Phantom series in 2023, the company’s first smartphone at a US$500+ price point).

The market made a strong comeback towards the end of 2023, driven by year-end holiday festivities and Transsion’s new product line-up, propelling the <US$100 price segment to more than double both quarterly and annually, said Angela Medez, Client Devices senior market analyst at IDC Philippines.

IDC raised its forecast for 2024 "given the high performance in 4Q23 and optimistic economic outlook as inflation continues to decline and private spending grows."

What do you think about this?

Post a Comment