.gif)

According to the latest data from independent analytics firm IDC, smartphone shipments in the Philippines declined for the fourth consecutive quarter.

In particular, it declined by 3.1 percent compared to last year even if it grew by 9.1 percent quarter-on-quarter (QoQ). 4.3 million units have been shipped in the country during the said period. One of the culprits in the rising cost of living and higher prices of essential goods.

IDC said that the smartphone shipments in the Philippines declined for the fourth consecutive quarter. One of the culprits in the rising cost of living and higher prices of essential goods.

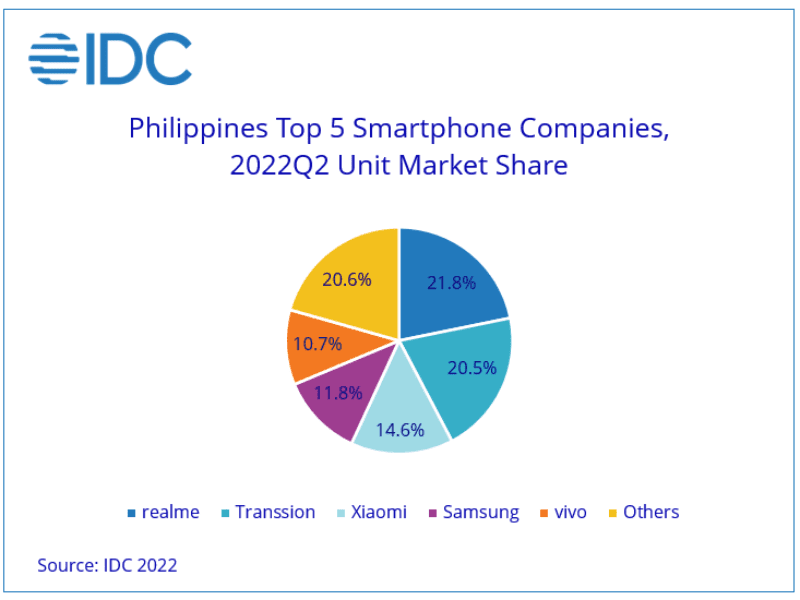

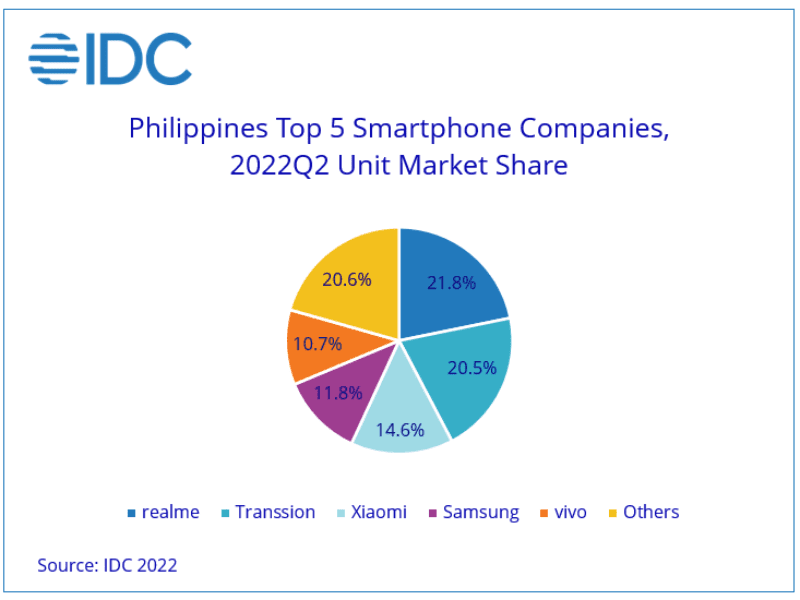

Top 5 smartphone brands in the Philippines 2Q22

|

| Top 5 in the Philippines 2Q22 |

On the very top is realme with 21.8 percent of the market share. This is the 6th consecutive quarter that realme topped the market. It grew by 17.5 percent QoQ and its realme 9 series and the launch of its TikTok store helped it maintain its lead.

Surging at number 2 is Transsion, the mega-company behind Infinix, TECNO, and itel. It increased its shipments by 152.2 percent YoY and 13.5 percent QoQ to capture 20.5 percent of the market.

Lower consumer spending also benefitted Transsion with an average selling price of just USD 103 (around PHP 5.7K) versus USD 194 of the overall smartphone market.

Infinix is responsible for 60 percent of its shipments. IDC said that the retail expansion plans and marketing campaign of the brand of Infinix helped the group grow.

Climbing at number 3 is Xiaomi thanks to the Redmi 10C smartphone. It grew by 1.2 percent YoY and 12.1 percent QoQ. It captured 14.6 percent of the pie.

Its sales through eTailers continued to drive growth with Xiaomi consistently listed as the best-selling mobile phone brand during Shopee's monthly sales campaign according to IDC.

Dropping at number 4 is Samsung. It declined by 23 percent QoQ and 12 percent YoY.

Coming back to the top 5 list is vivo thanks to its hero models Y15s and Y15a. Its launched of several new models at different price points also increased their ultra low-end segment (<USD 100) by 335.4 percent QoQ.

The number of smartphone shipments below US$ 200 improved significantly QoQ, as players such as Transsion and Cherry Mobile launched new models in this segment, but remained low on an annual basis, due to low demand and supply. The number of shipments for models in the higher price categories also slowed down as consumer spending declined due to economic headwinds, said Angela Medez, Market Analyst at IDC Philippines.

The rising cost of living and higher prices of essential goods and staple foods will continue to put pressure on consumer spending on smartphone. IDC expects 2022 will end with marginal growth of 2%, or flat compared to 2019, added Medez.

What do you guys think?

.gif)

Post a Comment